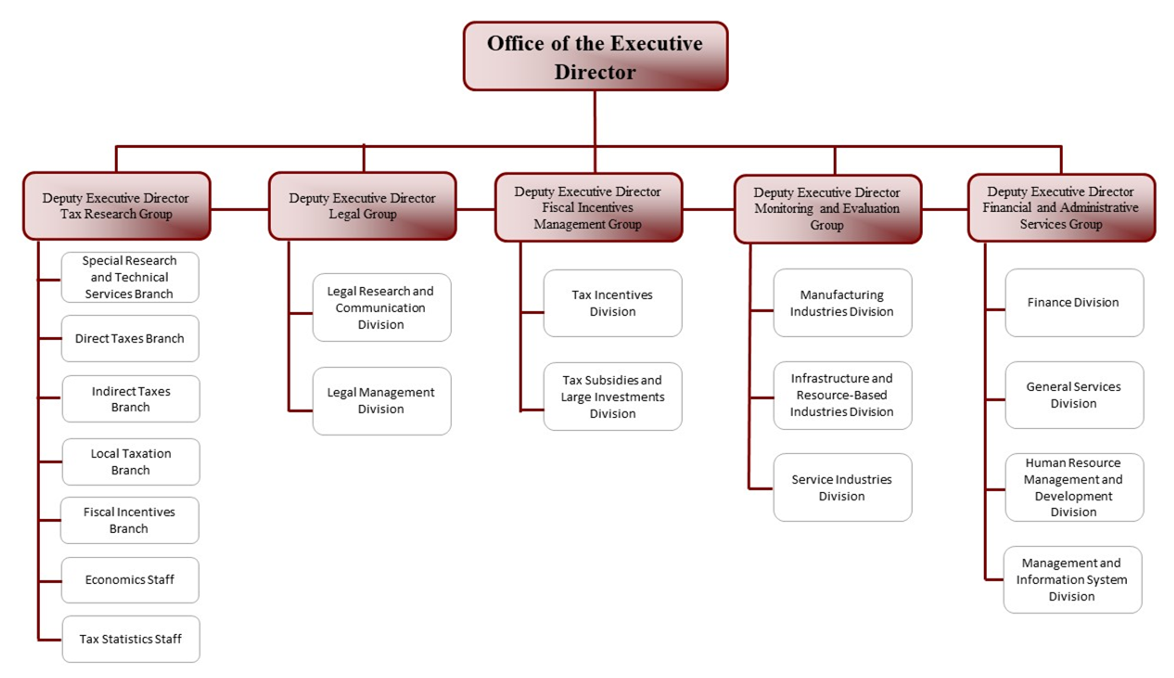

Organizational Structure

The NTRC is headed by an Executive Director assisted by five Deputy Executive Directors. The Office of the Executive Director exercises supervision and control over five groups, as follows: Fiscal Incentives Management Group, Monitoring and Evaluation Group, Legal Group, Tax Research Group, and Financial and Administrative Services Group.

OFFICE OF THE EXECUTIVE DIRECTOR (OED)

The Executive Director formulates, adopts, and promulgates rules and regulations to carry out the principles and objectives of the NTRC; recommends to and assists the DOF, the Congress of the Philippines and other government offices on matters pertaining to the Center’s areas of specialization; disseminates information on the work of the Center, and the background and the rationale of tax policies and the recommendations adopted by the government; exercises general supervision and control over the branches of the Center; and performs such other operations as may be provided by law.

Tax Research Group (TRG)

The TRG serves as the backbone of the Center as it carries out and fulfils the primary mandate of the Agency, which is to conduct continuing research in taxation and other fiscal-related matters in support of the policy directions of the Department of Finance (DOF) and the socio-economic agenda of the government in achieving fiscal sustainability. It is composed of specialized branches that provides comments on tax bills/resolutions requested by the Philippine Congress and DOF. The Group also extends technical assistance to both the private and public sectors on issues and matters pertaining to taxation and revenue generation. Further, it serves as Secretariat to the Task Force on the Revision of Fees and Charges which provides technical assistance and monitors the revision of fees and charges imposed by the national government agencies; and to the Executive and Technical Committees on Real Property Valuation of the Bureau of Internal Revenue as consultant. It also regularly publishes tax articles, which provide basic information on issues and cross-country comparisons as a way to increase consciousness of the public on taxation.

The TRG is composed of the following branches:

- Special Research and Technical Services Branch- Conducts research studies on revenue administration and customs and tariff matters, and other studies relating to the effective enforcement of government fees and charges and non-tax matters not falling within the area of responsibility of other branches; and renders technical assistance to Congress/DOF in the area of revenue administration and customs and tariff matters, fees and charges and valuation; and serves as the lead branch handling the Secretariat works of the NTRC to the Task Force on the Revision of Fees and Charges, and Consultant to the Executive and Technical Committees on Real Property Valuation of the BIR.

- Direct Taxes Branch- Conducts research studies on direct taxation to make it more responsive to the requirements of economic development; periodically re-examines existing tax exemption laws affecting direct taxes; and renders technical assistance to Congress/DOF in the area of direct taxes.

- Indirect Taxes Branch- Conducts research studies on indirect taxation to make it more responsive to the requirements of economic development; periodically re-examines existing tax exemption laws affecting indirect taxes; and renders technical assistance to Congress/DOF in the area of indirect taxes.

- Local Taxation Branch- Conducts research studies on the Local Government Code and other existing laws delegating to local governments certain taxing and revenue-raising powers commensurate with their respective levels of responsibility; recommends improvements in local taxation and local revenue administration, and the system of Internal Revenue Allotment to local governments to make the system more equitable; and renders technical assistance to Congress/DOF in the area of local finance.

- Fiscal Incentives Branch- Conducts research studies on the improvement and administration of fiscal incentives availment, and other studies relating to current and relevant experiences and practices of other countries regarding fiscal incentives and recommends the necessary changes/modifications to improve the Philippine incentives system; and renders technical assistance to Congress/DOF in the area of fiscal incentives.

- Economics Staff- Conducts research studies on the development of the Philippine economy and the rest of the world to further improve tax policies; submits reports on current developments in the general area of economics of taxation as basis for further in-depth studies; and renders technical assistance to Congress/DOF on the economics of taxation and public finance.

- Tax Statistics Staff- Conducts research studies using statistical techniques to provide indicators of the responsiveness of various taxes to changes in the economy; develops statistical procedures, methods and techniques for estimation and forecasting of revenue effects of existing and proposed tax measures; and develops, implements and maintain a system of collection, compilation and analysis and other public finance statistics.

- Planning and Coordinating Unit (Support to the Office of Directors)- Formulates jointly with the Tax Research Group, the NTRC plans and programs; coordinates activities of the Tax Research Branch/Staff; monitors periodically the performance of the office against planned targets and outputs; and takes charge of the publication and distribution of the NTRC Tax Research Journal, Guide to Philippine Taxes, Philippines Public Finance and Related Statistics and other tax information materials of the NTRC.

Legal Group (LG)

The LG assists the FIRB and the NTRC on all legal issues arising from the approval and disapproval of tax incentives and the suspension, withdrawal or cancellation of tax incentives and tax subsidy. The Group also provides legal opinions and/or technical papers on any legal issues that may be required by the FIRB and NTRC.

- Legal Research and Communication Division – prepares studies and/or position papers on the legal aspect of taxation, tax incentives and tax subsidies, fees and charges, and other legal issues that may be required by the FIRB and NTRC; compiles all legal documents, records, laws, resolutions, circulars pertaining to the FIRB; and media monitoring and crisis communications, as needed.

- Legal Management Division – provides legal support, drafts legal opinions, and assists the FIRB on the resolution of legal issues arising from the approval and disapproval of tax incentives and tax subsidies, and the suspension, withdrawal or cancellation of tax incentives and tax subsidies.

Fiscal Incentives Management Group (FIMG)

The FIMG processes applications for incentives entitlement of business enterprises with above P1 Billion investment capital and conducts initial evaluation of investment promotion agencies (IPAs) recommendations and ex-ante cost-benefit analyses (CBAs) and evaluates tax subsidy applications of government agencies.

- Tax Incentives Division – processes tax incentive applications of registered business enterprises (RBEs), for projects with investment capital above P1 billion including the initial evaluation of the IPA recommendations and review of ex-ante

- Tax Subsidies and Large Investments Division – processes applications for tax subsidies of GOCCs, state universities and colleges, government commissaries, and government instrumentalities, and applications for tax incentives of RBEs to be granted by the President including the initial evaluation of the IPA recommendations and review of ex-ante CBAs. It also monitors and evaluates compliance of GOCCs, SUCs, government commissaries and government instrumentalities on their utilization of tax subsidies, and IPAs and other government agencies administering tax incentives on their administration and grant of incentives; and checks and verifies their compliance with the rules and regulations of Title XIII of the NIRC, as amended, and other relevant laws, issuances and regulations.

Monitoring and Evaluation Group (MEG)

The MEG monitors and evaluates RBEs and other registered enterprises (OREs) on tax incentives availment and conducts ex-post CBA or other processes and impact evaluation methods to calculate the net benefits and cost associated with tax incentives; and provides summaries of performance metrics per IPA.

- Manufacturing Industries Division – monitors and evaluates compliance of OREs and RBEs engaged in the manufacture of food and beverages, miscellaneous manufacturers, non-food consumer goods, intermediate goods, and capital goods on their target performance metrics; conducts ex-post CBAs or other processes and impact evaluation methods, and checks; and verifies their compliance with the rules and regulations of Title XIII of the National Internal Revenue Code (NIRC), as amended, and other relevant laws, issuances and regulations.

- Infrastructure and Resource-Based Industries Division – monitors and evaluates compliance of OREs and RBEs engaged in real estate and housing; setting up of innovation and technology infrastructure and ecosystem; agriculture, forestry, fisheries and agribusiness; energy and energy related projects and activities; and activities/projects utilizing natural resources on their target performance metrics; conducts ex-post CBA or other processes and impact evaluation methods, and checks; and verifies their compliance with the rules and regulations of Title XIII of the NIRC, as amended, and other relevant laws, issuances and regulations.

- Service Industries Division - monitors and evaluates compliance of OREs and RBEs engaged in public utilities and basic services, business process outsourcing (BPO) and non-BPO activities on their target performance metrics; conducts ex-post CBA or other processes and impact evaluation methods, and checks; and verifies their compliance with the rules and regulations of Title XIII of the NIRC, as amended, and other relevant laws, issuances and regulations.

Financial and Administrative Services Group (FASG)

The FASG provides support services in financial management and reporting, human resources development and management, general services, records, and inventory management and management information systems and technology.

- Finance Division – provides financial advice and monitors the agency’s financial system, and ensures accurate and timely reporting of financial reports in conformity with COA, DBM, BIR and other regulatory requirements.

- General Services Division – provides administrative services, management of inventories including procurement planning and utilization, facilitate outsourced services, and records management.

- Human Resource Management and Development Division – provides human resource management and development in the areas of recruitment, selection and placement, performance management, learning and development, and rewards and recognition and ensures the implementation of policies relating to human resource in conformity with Civil Service Commission, Career Executive Service Board and other regulatory requirements.

- Management and Information System Division– determines the appropriate information technology needs, provides technical support on information systems and database management, and ensures that sufficient technology and processes for information systems, information technology devices and equipment are in place and are adequately maintained.

.png)